Home Buyer tips and tricks “Your Escrow Account”

When is an Escrow account needed?

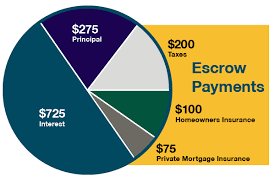

If you put less than 20% down you will be required to have an escrow account to pay your taxes and homeowners insurance. An escrow account is account your mortgage servicer will hold on your behalf to collect monthly amounts (included with your payment) to pay your taxes and insurance when they are due. Your lender does not collect interest on this account.

How does it work?

At closing your lender will collect payments to set up an escrow account. Generally they will collect monthly amounts in advance for summer tax, winter tax, school tax, and homeowners insurance. Which ever applies to your city \ county. For example: if your summer taxes are due in July and your first mortgage payment is due in March they will collect 7 month’s worth of that tax at closing. You would have made 5 payments by July therefore you would have 12 payments in escrow when this tax is due. Now there is enough to pay the total for the year.

What happens next?

Your servicer will also hold a reserve for overage at closing this will be called an aggregate adjustment on your closing disclosure. Generally a 2 month reserve for each item will be held. Each calendar year there after your account will be reviewed and a new reserve will be set up causing either a refund (if your taxes or insurance have gone down) or a shortage (if your taxes or insurance go up).

A shortage will require you to either mail in the short amount or increase your payment to cover the shortage over the next 12 month’s. This can feel like a double whammy in your payment because not only do you have to adjust for the increase you also have to make up the shortage. Sometimes it is better to just mail in the shortage amount to avoid drastic increases in your payment. This will typically happen after the first year you purchase a home. That is the time when your taxes can go up the most.

Its a good idea to review your annual escrow statement so you can anticipate your payment adjustment. One will be mailed to you every year on the anniversary of your closing.